Bordeaux: Buying Guide

With Bordeaux En Primeur in full swing, investors and drinkers alike are getting a first look at what the 2020 vintage has to offer. Thus far, it would appear that this is another very investible year for the long coveted region.

This will mark three consecutive years where critics and industry professionals have reported high quality vintages, and investors should look to capitalize. There have been reports that 2021 has already been marred by an early frost, which could mean that the trilogy is coming to an end.

For investors, it could also mean that there are opportunities afoot. Three years of strong vintages means that the market has had an increasing supply of investible wines. If 2021 ends the winning streak, prices for 2018, 2019 and 2020 could see upside potential.

Here are 3 wines we like at Vinovest.

Picks Provided by Vinovest Research Team. All rates of return are based on investment grade cases of bottles.

Further reading

- New to investing in wines? Here's our Ultimate Guide to Fine Wine Investment.

From The Classics: Chateau Margaux

In terms of investing in wine, this one is an old reliable. One of the five Bordeaux First Growths declared in the 1855 Classification of the Napoleonic era, Chateau Margaux is always watched by wine lovers. We like the 2019 and 2020 vintages due to valuation vs. supply.

James Suckling noted very early on in En Primeur 2020 that Chateau Margaux had suffered a 30% decrease in production. He also noted that the vineyard’s Merlot was one of the wines of the vintage.

This creates a unique opportunity to chase not only a supply crunch, but also to take advantage of the weaker prices of the 2019 vintage. The London Vintners Exchange noted in May that the 2019 Margaux was one of the lowest priced wines from the first growths currently being traded. Ironically, its scores were not dissimilar to that of the 2018 and burgeoning 2020 vintages.

The 30% decline in 2020 output means that buyers will struggle to get their hands on it, creating the impetus for renewed interest in the 2019 vintage at discounted prices.

Going right for the 2020 is a play on supply, but you’ll have to wait for it to hit the market, unless you’re buying En Primeur. Our 2019 call is a play on COVID-19, and the impact it had on most industries globally. Buyers weren’t sure what was happening, and prices took a hit.

Relative to the stock market, think of Chateau Margaux as the JPMorgan (NYSE:JPM) of wine. It is established, with a long history of success. Jumping into Margaux is not a risky proposition, and remains a staple of any true wine collection.

A Rising Contender: Château Figeac

Situated in St-Emilion, Château Figeac has been striving for a decade to reach the heights of top tier status. Within the region of St-Emilion, producers are reclassified every ten years based on their performance. It is one of the key drivers that produces the incredible quality of this region.

The next reclassification is set to take place in 2022. The process can be a contentious one, with the 2012 reclassification causing stirring debates over how these producers are judged.

At present, there are only four Chateaux that garner the coveted Grand Cru Classe A designation.

Figeac’s Premier Grand Cru Classe B, has shown strong investment potential for the right vintages. The 2015 has seen its value appreciate by 39% over the last 12 months, to roughly $2,600 for a 12 bottle case. Should the Chateau see its status rise to a first tier, there could be significant increases in demand for their newer vintages.

Relative to the stock market, Chateau Figeac is comparable to a company that is just about to get added to the S&P 500.

Figeac. The region of St-Emilion does a reclassification every 10 years. Figeac is currently in the second tier but they have been absolutely killing it over the past nine years and are almost a shoe in to be upgraded to the first tier next year

Management Shakeup: Château La Clotte

The 2020 La Clotte seems intriguing. Owned by the Vauthier family of Ausone, who acquired a majority stake in the estate back in 2014, La Clotte has seen extensive efforts to improve its quality.

Chateau Ausone makes one of the four wines that currently carry the top Premier Grand Cru Classe A classification. The Vauthier family brought that experience with them, and have been making huge improvements to some winemaking practices and marketing as a whole for La Clotte.

Cases are acquireable for less than $1,000, but have yet to show the investment potential of counterparts. This is very much the “sleeper” play. La Clotte has much lower trading volumes than more popular Grand Cru Bordeaux, and its weaker status is what sets it up for investors to get in ahead of the action.

Wine Critic Jane Anson gave the 2020 vintage a score of 93, with positive commentary on the improvements being made. There is a lot of risk/reward here. Wise investors would avoid making La Clotte too significant a piece of their portfolio.

Relative to the stock market, think of Chateau La Clotte as a solid mid cap company that has been acquired and is undergoing restructuring to drive value. If you are a true wine lover, these are also more accessible Grand Cru bottles for those looking to drink something exceptional.

How To Buy

To be clear, our 2020 calls will require you to dive into wine futures, or wait for them to come onto the market.

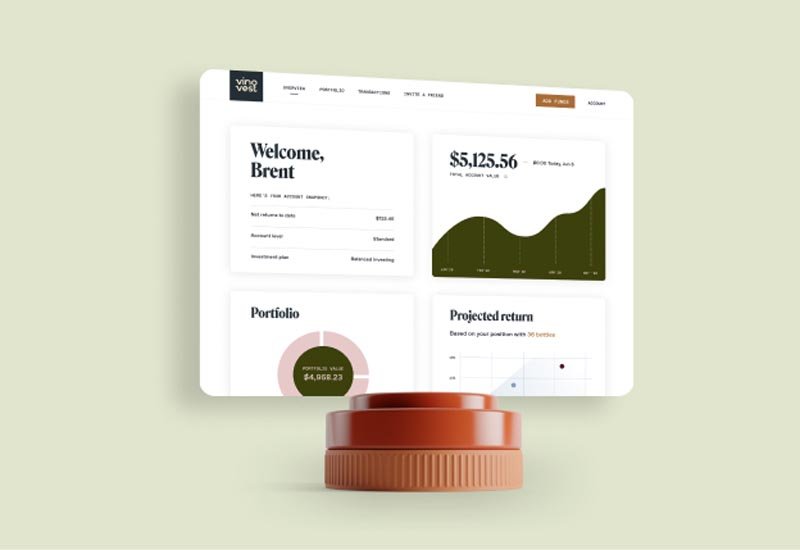

Vinovest offers wine futures trading to those that meet our premium client account requirements. You can also go the traditional route of buying bottles through our regular service. We handle the procurement, shipping, and storage of your investments, in secure, insured professional warehousing.

Either way, 2020 is looking like it’s shaping up to be one more year of quality investment grade wines from Bordeaux, France.

Thanks to tech, it has never been easier to invest in wine.