What Are Sin Stocks? (9 Stocks to Consider, Are They Worth It?)

Want to profit from the vices?

Sin stocks might be your answer. They tend to perform well regardless of economic turbulences.

So, what are sin stocks, and which ones should you invest in?

Let’s also explore how they’re valued, the 10 best sin stocks to invest in, how to approach investing in them, and if it’s worth investing in these assets.

We’ll then check out an excellent alternative asset (fine wine) that deserves a spot in your investment portfolio.

Further reading

- Looking for profitable assets for your portfolio? Check out these 15 Best Alternative Investments.

- Also, be sure to check out this Fine Wine Investment Guide.

What Are Sin Stocks?

Sin stocks (or vice stocks) are the shares of companies that some people consider “unethical”.

For example, gambling, alcohol, tobacco, sex-related industries, and weapons manufacturers.

However, the term “sin stock” is quite controversial.

Not everyone considers alcohol a sin stock. That’s because brewing beer or producing fine wine is considered part of a tradition in some parts of the world.

People also have different views about the provision of weapons to the military. This means not everyone would consider military stocks sinful.

So, the exact definition of a “sin stock” usually depends on your views about the stock in question.

Now, let’s check out how these stocks are valued.

How Are Sin Stocks Valued?

Like any other stock, sin stocks are valued based on their ability to generate consistent profits.

The best way to evaluate these stocks is to use their price-to-earnings (P/E) ratio.

A high P/E ratio usually means that a stock is overvalued.

In some cases, a high P/E ratio indicates that investors are expecting higher stock returns in the future. So, such investors are willing to pay a lot of money for that particular stock.

You can also evaluate sin stocks by using the price-to-book (P/B) ratio. The P/B ratio compares the company’s book value to its market value. In simple terms, the book value refers to the net assets of a company.

A high P/B ratio usually means that a stock is overvalued or performs well.

So, what are the best sin stocks to invest in?

The 10 Best Sin Stocks to Invest In (2022)

Here are the 10 sin stocks you should consider adding to your portfolio:

- Constellation Brands, Inc. Class A (NYSE: STZ)

- Anheuser-Busch Inbev SA (NYSE: BUD)

- British American Tobacco PLC (NYSE: BTI)

- MGM Resorts International (NYSE: MGM)

- Philip Morris International Inc. (NYSE: PM)

- Penn Entertainment Inc (NASDAQ: PENN)

- Las Vegas Sands Corp. (NYSE: LVS)

- Smith & Wesson Brands Inc (NASDAQ: SWBI)

- Aurora Cannabis Inc. (NASDAQ: ACB)

- Amyris Inc (NASDAQ: AMRS)

1. Constellation Brands, Inc. Class A (NYSE: STZ)

Constellation Brands has a diversified portfolio comprising wine, spirits, and beer brands.

The company grew rapidly in the last decade - it’s now the third-largest wine and spirits producer in the US after E & J Gallo Winery and The Wine Group. This company generates a steady cash flow.

This alcohol stock has a “strong buy” rating and a target price of $282.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 46.94B USD

Volume: 1.04M

P/E Ratio: 37.73

Dividend Yield: 1.29%

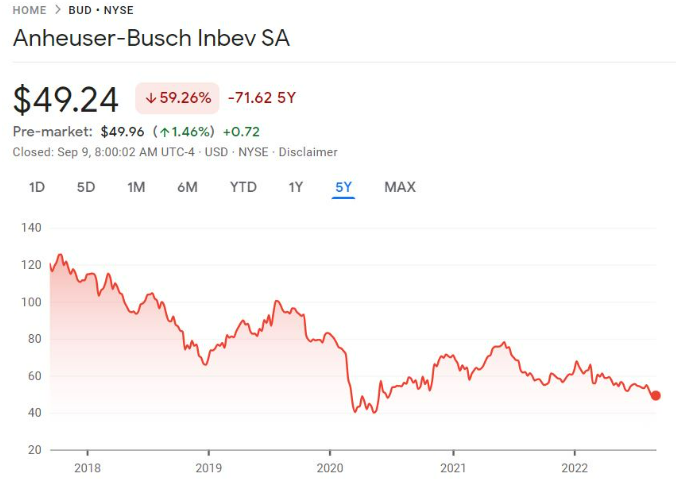

2. Anheuser-Busch Inbev SA (NYSE: BUD)

Anheuser-Busch Inbev is one of the world’s largest brewing firms. It generates a steady cash flow and owns well-known beer brands like Budweiser and Stella Artois.

This alcohol stock has a “buy” rating and a target price of $62.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 86.45B USD

Volume: 1,12M

P/E Ratio: 25.78

Dividend Yield: 1.12%

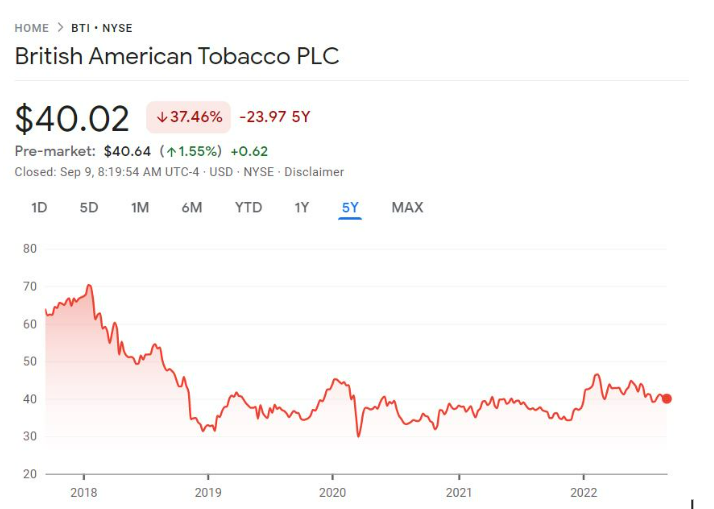

3. British American Tobacco PLC (NYSE: BTI)

British American Tobacco produces and sells cigarettes, tobacco, and other nicotine products.

The big tobacco company has a “buy” rating and is one of the best tobacco stocks worth adding to your portfolio.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 90.71B USD

Volume: 1.65M

P/E Ratio: 14.61

Dividend Yield: 7.43%

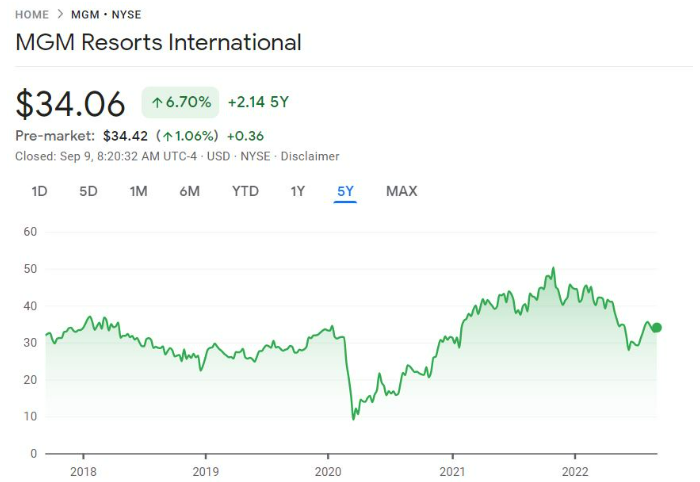

4. MGM Resorts International (NYSE: MGM)

MGM Resorts International is a hospitality and entertainment company that operates casino resorts in the USA and China.

The company’s Q2 financial statements (released in August 2021) indicate that the net revenue surged 683% year-on-year (YOY) to $2.3 billion.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 13.39B USD

Volume: 4.62M

P/E Ratio: 4.87

Dividend Yield: 0.03%

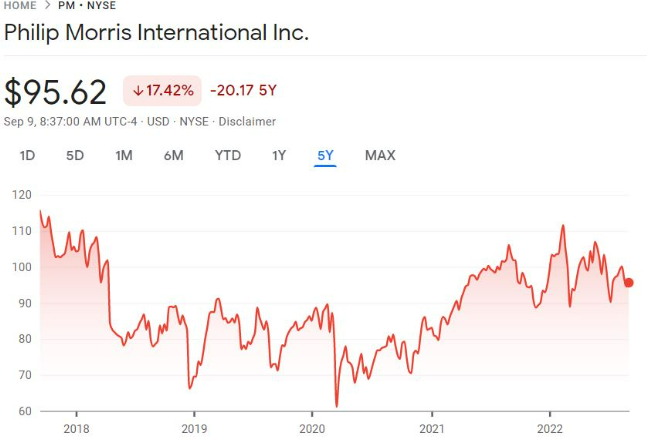

5. Philip Morris International Inc. (NYSE: PM)

Philip Morris International is a big tobacco company that sells products in over 180 countries.

This stock has a “strong buy” rating and a target price of $106. It’s one of those tobacco stocks that any individual investor should consider adding to their portfolio.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 148.23B USD

Volume: 3.04M

P/E Ratio: 16.40

Dividend Yield: 5.24%

6. Penn Entertainment Inc (NASDAQ: PENN)

Penn Entertainment (formerly known as Penn National Gaming) operates casinos and racetracks in Wyomissing, Pennsylvania.

The company’s Q2 results (released in early August 2021) show a revenue growth of 405% YOY to $1.55 billion.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 5.11B USD

Volume: 2.35M

P/E Ratio: 27.30

Dividend Yield: N/A

7. Las Vegas Sands Corp. (NYSE: LVS)

Las Vegas Sands is a casino and resort company headquartered in Nevada, USA.

This stock has a “strong buy” rating and an average target price of $49.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 28.77B USD

Volume: 3.15M

P/E Ratio: 15.57

Dividend Yield: N/A

8. Smith & Wesson Brands Inc (NASDAQ: SWBI)

Smith & Wesson Brands is one of the largest firearms and weapons manufacturers in the United States.

Its Q1 results (released in early September 2021) indicate that the net revenue increased by around 20% YOY to $275 million. This is a good option for any sin stock investor.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 614.60M USD

Volume: 1.46M

P/E Ratio: 3.30

Dividend Yield: 2.91%

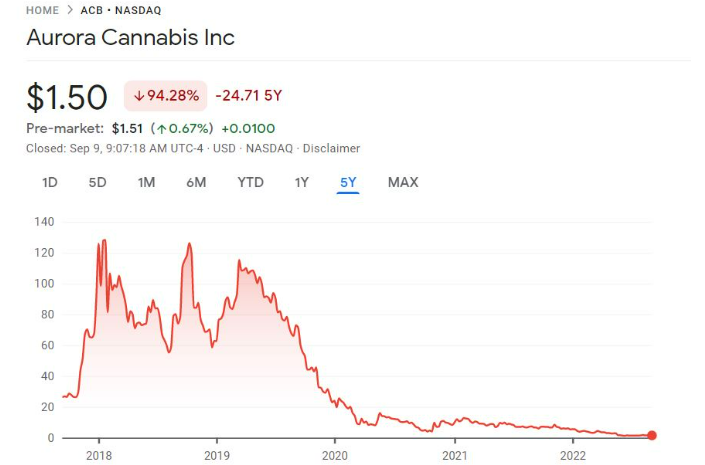

9. Aurora Cannabis Inc. (NASDAQ: ACB)

Aurora Cannabis is a Canadian company that sells high-quality medical and recreational cannabis products. It has expanded into the US by acquiring companies such as Anandia Laboratories Inc.

This stock has a “buy rating” and a target price of $1.40.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 339.76M USD

Volume: 8.22M

P/E Ratio: N/A

Dividend Yield: N/A

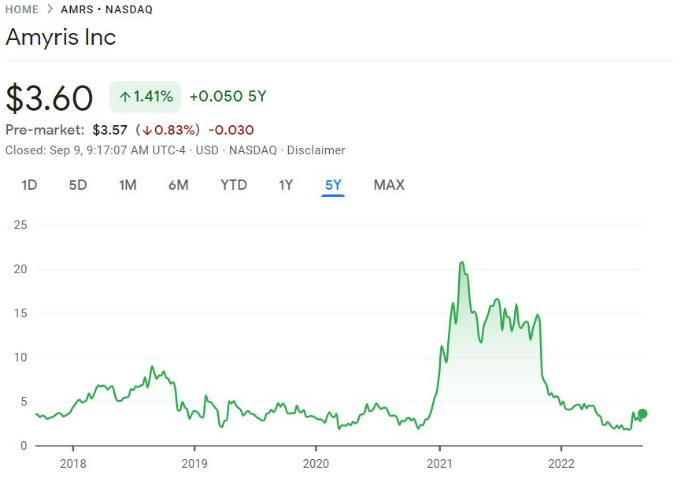

10. Amyris Inc (NASDAQ: AMRS)

Amyris Inc is a California-based synthetic biotechnology company well-known for producing health and beauty products.

This firm also produces synthetic cannabinoids (substances found in the cannabis plant.) So, it could be an ideal option for cannabis investors.

Its Q2 results (released in early August 2021) show a revenue growth of 74% YOY to $52 million.

Historical 5-Year Performance

Source: Google Finance

Market Cap: 1.16B USD

Volume: 7.29M

P/E Ratio: N/A

Dividend Yield: N/A

Let’s now explore the best ways to approach investing in sin stocks.

How to Approach Investing in Sin Stocks

If you want to make a profit from sin stocks, here are some of the things you need to do:

- Observe Consumer Trends: Not every sin stock is worth adding to your portfolio. So, look out for the top-performing assets. Check out market surveys and trend reports for the sin industry you’re interested in.

- Invest in a Range of Sin Stocks: Gambling is often considered illegal in some US states and other parts of the world. This means investing in sin stocks such as Wynn Resorts and other casinos might be risky. As a passionate sin stock investor, do your research before picking the stocks.

- Consider the Liquidity Risk Involved: When picking a sin stock, you need to ensure that it’s liquid. Pick a sin industry stock that you can easily buy and sell at any time.

Should You Invest in Sin Stocks?

Sin stock investing is often considered the opposite of ESG investing (Environmental, Social, and Governance investing.)

ESG investing refers to sustainable or ethical investing. It’s a strategy where investments are made considering the environment, the economy, and human well-being.

Ethical and sustainable companies are usually given high ESG scores (ratings that evaluate how a company prioritizes sustainability.)

So, assets with low ESG scores might not sound ideal to ethical investors.

But here’s the thing: most non sin stocks are usually volatile. In fact, a majority of non sin stocks usually plummet in value during recessions and other economic downturns.

Meanwhile, a traditional sin stock like Molson Coors or other alcohol firms usually yields a consistent return on investment when compared to the stock market. So, defense and alcohol firms like Molson Coors and Constellation Brands are usually profitable.

Now, as an individual investor, you must explore sin stocks and enjoy the stock returns.

But if you want a more sustainable, reliable investment, look no further than fine wine investment through Vinovest.

Fine Wine: The Most Reliable Asset to Add to Your Portfolio

If you’re looking for an asset that always delivers lucrative returns, fine wine is all you need.

But why invest in fine wine?

Fine wine usually delivers consistent returns despite the state of the economy. It is less volatile than traditional assets like stocks and ETFs.

Here’s an interesting fact - the Knight Frank Wealth Index indicates that fine wine appreciated in value by 137% in the last decade (outperforming other assets like watches.)

No wonder why most modern individual and institutional investors love this alternative asset.

Now, here’s the best part:

Buying and selling wine is super easy - as long as you use a reputed investment platform like Vinovest.

Here are the easy steps for signing up with Vinovest:

- Sign up on the Vinovest website.

- Answer a quick questionnaire to determine your investing style and risk appetite.

- Fund your account with a minimum of $1,000 (using a credit card or any other payment method.)

- Sit back, relax, and let Vinovest’s investment managers handle everything. They’ll even help you pick the right asset allocation strategies.

So, why invest through Vinovest?

Vinovest safely stores your wines in bonded warehouses (you don’t have to pay any VAT or excise duty for this.) It charges you a 2.5% annual fee (1.9% for portfolios of $50,000+), which covers storage, insurance, portfolio management, and fraud detection.

But that’s not all - there are tons of other benefits too! Check out the Vinovest website to discover more.

Invest Beyond Sin Stocks, For Enviable Long-Term Returns

Sin stocks (vice stocks) might be considered unethical by other investors. However, there’s no denying that most of these assets offer lucrative returns.

Only pick your sin stocks wisely to get the best stock returns.

Want an asset that usually outperforms the stock market, ETFs, and other investments? Look no further than fine wine!

Visit the Vinovest website and start investing in fine wine bottles from France, the United States, and worldwide. Vinovest’s investment managers will handle everything for you - from asset allocation and storage to portfolio management.