What Your Wine Portfolio Could Look Like at Vinovest

Tell me if this sounds familiar. You heard about Vinovest. You did your research. Then, you’re about to open an account and wonder, “How much is my money going to actually get me?”

If you’ve had that exact thought, you’re not alone. And unless you hopped on a call with a portfolio advisor, you might have been left in limbo. Until now. Here’s a breakdown of what your wine portfolio could look like with Vinovest based on your initial deposit.

Further reading

- Learn everything about Fine Wine Investment in this super-insightful article.

- Check out our Complete Guides on The Classic Bordeaux and White Burgundy Wines.

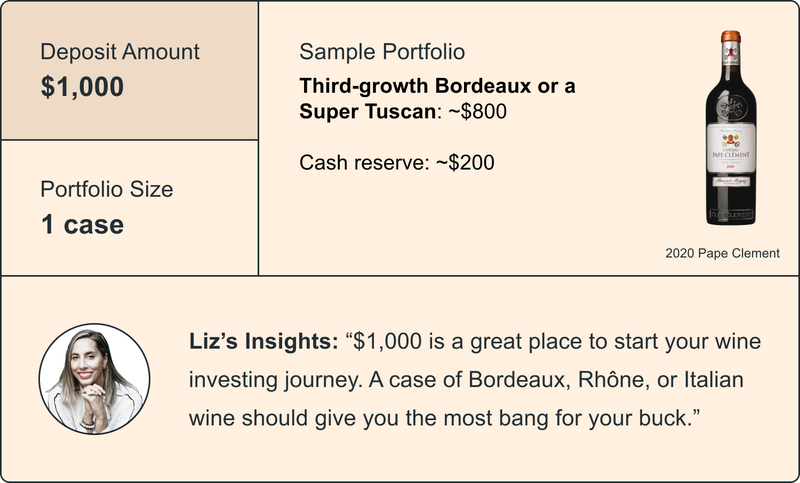

Wine Investing with $1,000

As our Head of Wine, Liz Dowty-Mitchell put it, “$1,000 is a great place to start your wine investing journey.” You can dip your toes in wine investing without breaking the bank. You won’t have widespread diversification, but one or two is better than none.

The best value will likely come from Bordeaux, Rhône, or Italy. Bordeaux has long been the gold standard for fine wine. Even in an increasingly competitive industry, it routinely commands the largest share of trade on the secondary market, making Bordeaux a staple in any wine portfolio.

Meanwhile, Rhône and Italian wine share several similarities in terms of performance. Both regions have demonstrated consistent growth and low volatility in recent years. Add in exceptional value for the price, and these regions serve as ideal starting places for wine investing newbies.

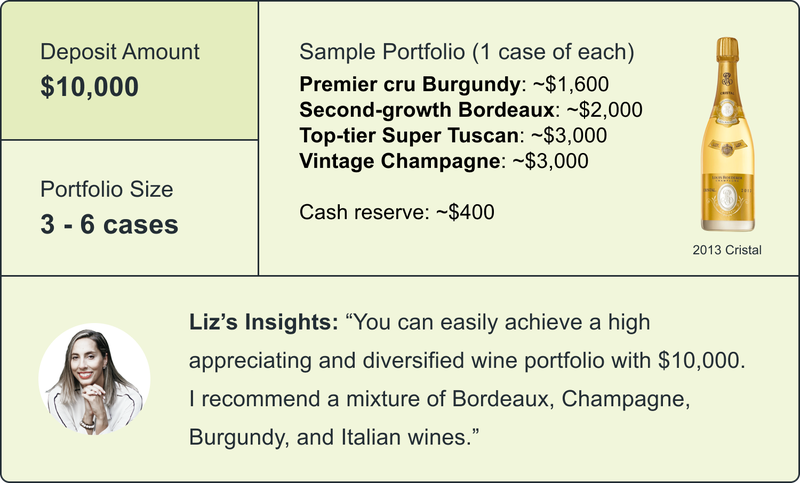

Wine Investing with $10,000

If you’re serious about protecting and growing your wealth, $10,000 is a great place to start. You can build a diversified wine portfolio without skimping on major labels, like Sassicaia, Krug, or Opus One. It’s why Plus ($10,000 to $49,999) is the most popular tier among Vinovest clients.

When asked about the ideal portfolio construction at this level, Liz said, “I recommend a mixture of Bordeaux, Champagne, Burgundy, and Italian wines.” Mental note made. Bordeaux and Italy are home to myriad timeless names in the wine world. No matter the market conditions, there should always be demand.

Meanwhile, according to Liv-ex, Burgundy (93.8%) and Champagne (87.6%) have been the best-performing regions over the last five years. Adding a case or two from these regions will ensure a healthy mix of wines by style, brand strength, and region.

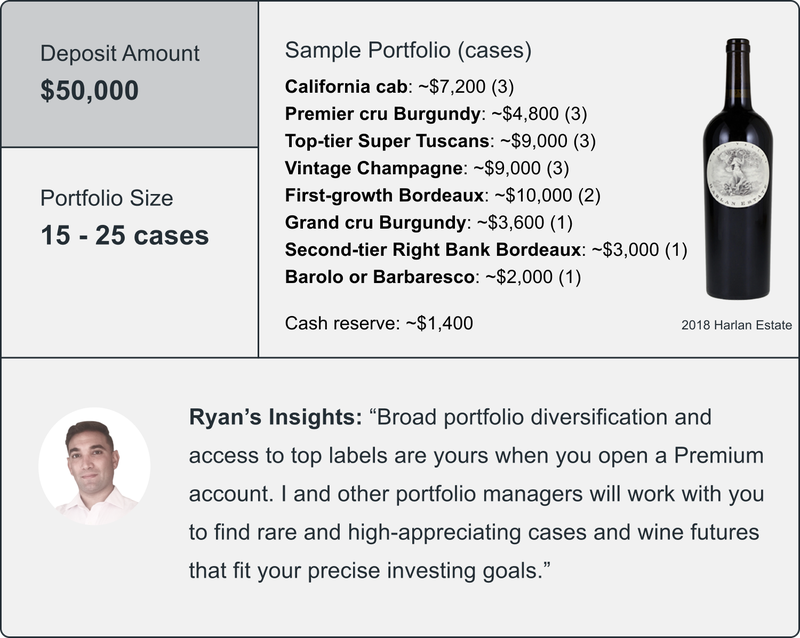

Wine Investing with $50,000

The fun begins when you invest $50,000 or more. Nearly every rare and expensive wine, including first-growth Bordeaux and California cabs, is within reach. That’s not all. You can thoroughly diversify your portfolio across different regions and time horizons.

The real question is: what are your unique investing goals and risk levels? Perhaps, you’re a risk taker. You may want high exposure to wines from up-and-coming estates with exponential growth potential.

Or, maybe you’d rather insulate your wealth from the chaos of the global economy. In that case, historically consistent wines should suit your financial palate. After all, who would object to owning some Château Lafite Rothschild or Petrus. No matter your answer, our portfolio managers will help you find the right wines.

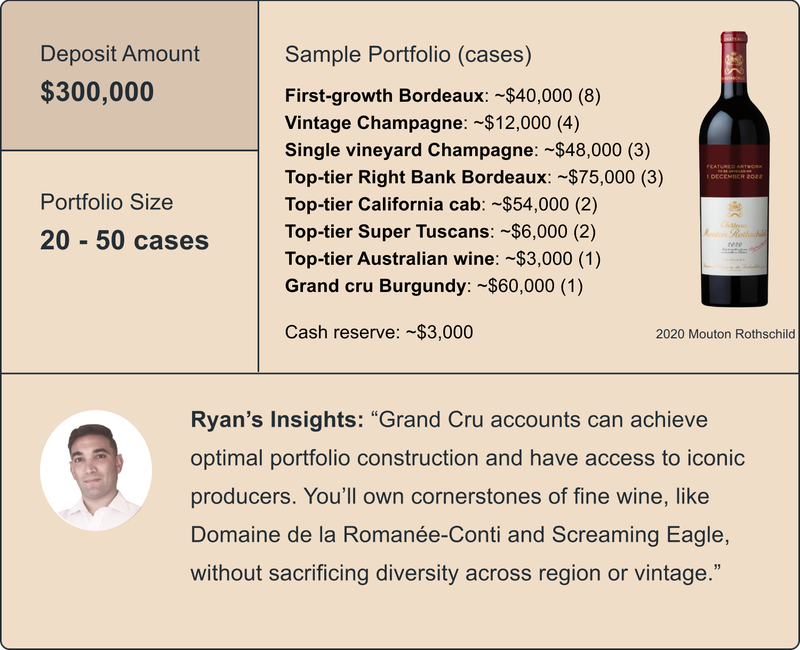

Wine Investing with $300,000

For those who invest at the Grand Cru level (our highest tier), you are in the driver’s seat. As our portfolio manager, Ryan La Valle, put it, “Grand Cru accounts can achieve optimal portfolio construction and have access to iconic producers.” Even the rarest and most expensive labels, like Domaine de la Romanée-Conti and Screaming Eagle, are in play.

Much like the $50,000 level, our portfolio managers will work with you to select wines. Your precise portfolio will depend on your investing preferences and goals, including when you’d like to sell.

The Grand Cru tier also comes with special perks, like first dibs on exclusive wine releases and personalized quarterly reports. Heck, you even have access to our Vinovest advisory council. Now, that’s something worth raising a glass to.

Make Your Feedback Heard with the Vinovest Community

I have a confession. The idea for this blog post didn’t come from me at all. Instead, the inspiration came from someone in the Vinovest Community.

During office hours with Liz, someone brought up this pain point - how much wine will my money get me at Vinovest? (Fast forward to 19:04 to watch the exchange). Sharing that pain point led to a domino effect that resulted in several changes with our marketing, including the creation of this blog.

If you have an idea for how we can make Vinovest better, I’d love to hear it. Sign up for the Vinovest Community, and leave a recommendation in the Feedback channel. I read every suggestion and look forward to what you have to say.