Active rebalancing is the process of strategically buying and selling assets in your portfolio to maintain the ideal balance of diversification, risk, and growth potential, ensuring your portfolio stays aligned with your financial goals as markets evolve.

When you start your investment journey with us, our team curates a portfolio by allocating your funds into a mix of assets that match your time horizon and risk tolerance. Over time, as the market moves, the growth of some of your holdings might outpace the others, leaving you overexposed to higher-return—but also higher-risk—assets. Since these selling opportunities come and go quickly, we use an active rebalancing strategy to act quickly on these market movements and get you back to your target allocation without missing a beat.

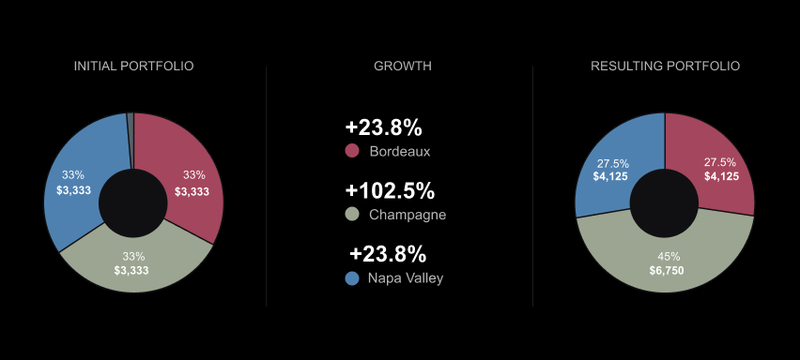

As a hypothetical (simplified) example, let’s say an investor begins with their initial investment funds of $10,000 as shown below. Over time, Champagne has a particularly bullish run and the Champagne holdings grow faster than the other two regions in their portfolio.

Now, almost half of their portfolio’s value is staked on the success of a single region. That’s more risk tolerance than ideal for this investor. If the Champagne market were to reverse course, this investor would experience outsize losses.

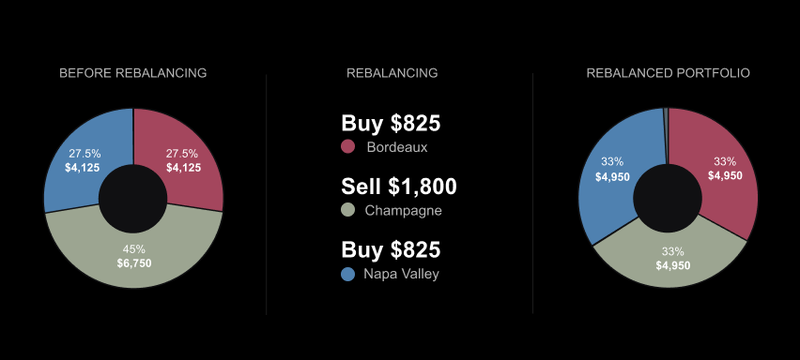

To rebalance this portfolio, our team would note the strong growth in Champagne and reduce the portfolio exposure accordingly.

In short, active rebalancing helps keep your portfolio at the right level of risk for you. It’s built right into our platform, so you can rest assured that your holdings will be maintained at the optimized risk-reward balance, and you won’t need to lift a finger (or worry about following wine index tickers).